In the dynamic world of digital assets, three names consistently dominate headlines and drive the majority of market movement: Bitcoin (BTC), Ethereum …

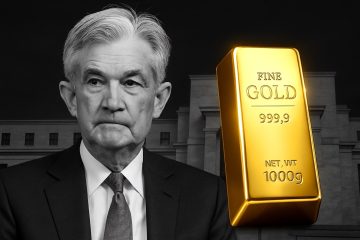

Gold Price Soars Past $4,500, Eyes 4% Weekly Gain After US Non-Farm Payrolls Report

Gold has launched above the $4,500 per ounce mark, setting the stage for a significant weekly gain of nearly 4%. This …

Major PEPE Holder Absorbs Massive Loss, Fueling Speculation on a $0.00001 Comeback

The volatile world of meme coins is witnessing a high-stakes drama unfold as a significant PEPE holder, known colloquially as …

Gold’s Rally Stalls: Awaiting Economic Catalysts to Break the Range

The lustrous run for gold appears to be pausing, caught in a tug-of-war between persistent macroeconomic undercurrents and imminent data. …

Crypto Market Analysis: Why Bitcoin, Ethereum, and XRP Are Dropping Today

The cryptocurrency market has turned sharply red, with major digital assets posting significant daily losses. Leading the downturn, Bitcoin (BTC) and Ethereum (ETH) have retreated from …

Gold (XAUUSD) Price Forecast: Brace for a Pullback as Massive $6.8 Billion Rebalancing Looms

The gold (XAUUSD) rally is facing its most significant near-term test. After a powerful surge toward all-time highs, our analysis …

Shiba Inu Ignites 535% Surge in Token Burns Amid Growing Speculation of a Meme Coin Revival

Shiba Inu (SHIB) has re-entered a potential breakout phase, with analysts identifying a clear technical target approximately 26.45% above its …

Ethereum Surges as Institutional Players Signal Major Accumulation – Key Price Levels to Watch

Ethereum (ETH) is demonstrating renewed momentum, marking its fourth consecutive day of gains as bullish sentiment grows among long-term holders. …

PEPE in 2026: Can a Zero-Utility Memecoin Survive an Evolving Market?

With a market cap hovering around $2.6 billion and daily trading volume often surpassing $900 million, PEPE stands as a paradox in the …

Gold’s Historic Surge: Analyst Predicts $5,000 as Inflation Reshapes Global Finance

Gold concluded the year with a remarkable 66% gain—its strongest annual performance since 1979—firmly holding above $4,300 per ounce. As the precious …